When you’re young, saving for retirement is probably the last thing on your to-do list. After all, your retirement is so far away, while you’re focused on more immediate concerns such as schoolwork, a job and day-to-day family responsibilities. But it’s never too early to start saving for those golden years, and the sooner you start, the better.

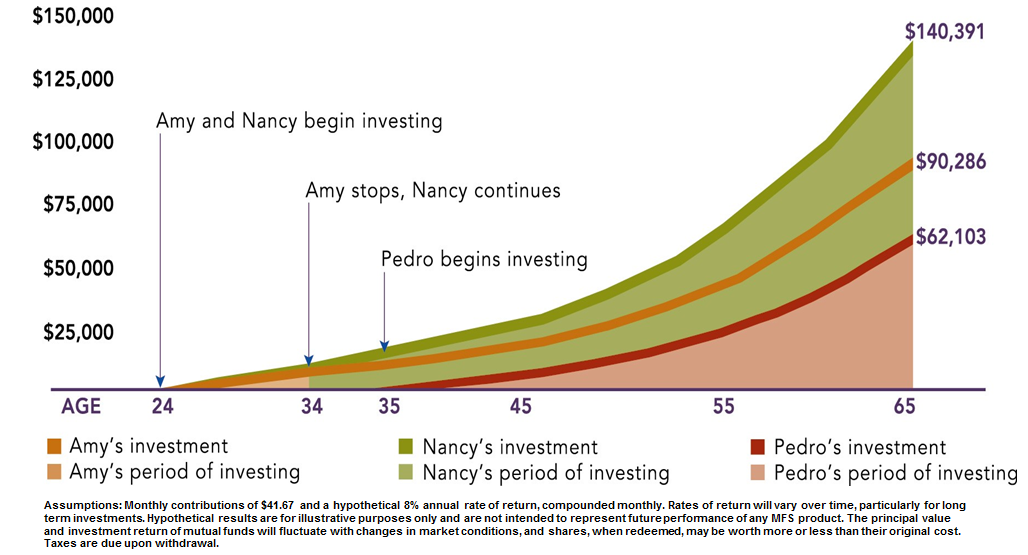

Why now? Because time is on your side. By saving even a few dollars each paycheck, you can take advantage of the power of compounding interest, in which interest earnings are added to the amount you save (principal) so that the added interest also earns interest from then on. So the earlier you start saving, the more your savings can grow.

Check out the example below to see how starting early can really pay off. Just by starting to save early Amy and Nancy have an advantage over Pedro. But when Amy stops saving and Nancy continues you can see the difference in their accounts at their desired retirement age. Pedro waited until he was 35 to start saving and you can see that his account is significantly less than Amy and Nancy’s. Time is on your side, and using Time to Save to make contributions to your savings can go a long way with compounding interest.

Tax-favored retirement accounts such as individual retirement accounts (IRAs) and 401(k)s are the best places to save for retirement. There are different types of plans with many different features, but most of them allow you to defer taxes on the money you save and the interest you earn within the account.

Every little bit counts, and by making all your online purchases through Time to Save we can help you to put even more aside for retirement. When it comes to saving for your retirement, it’s never too early to start saving, so start securing your financial future today.